Alphabet (Google) Stock Forecast 2024, 2025, 2030

Alphabet’s (GOOGL) stock price recently reached an all-time high closing price of $159.41 – but are additional gains possible, or has it struck a ceiling?

Shares in the US tech behemoth, which owns search engine Google, have risen $14.54% year to far and 49.34% during the 12-month period ending April 24, 2024.

But is it the time to buy GOOGL stock, or should potential investors wait? What are the latest Alphabet stock predictions from industry experts?

In our Alphabet stock projection, we look at the stock’s key performance factors and what to expect in 2024, 2025, and beyond.

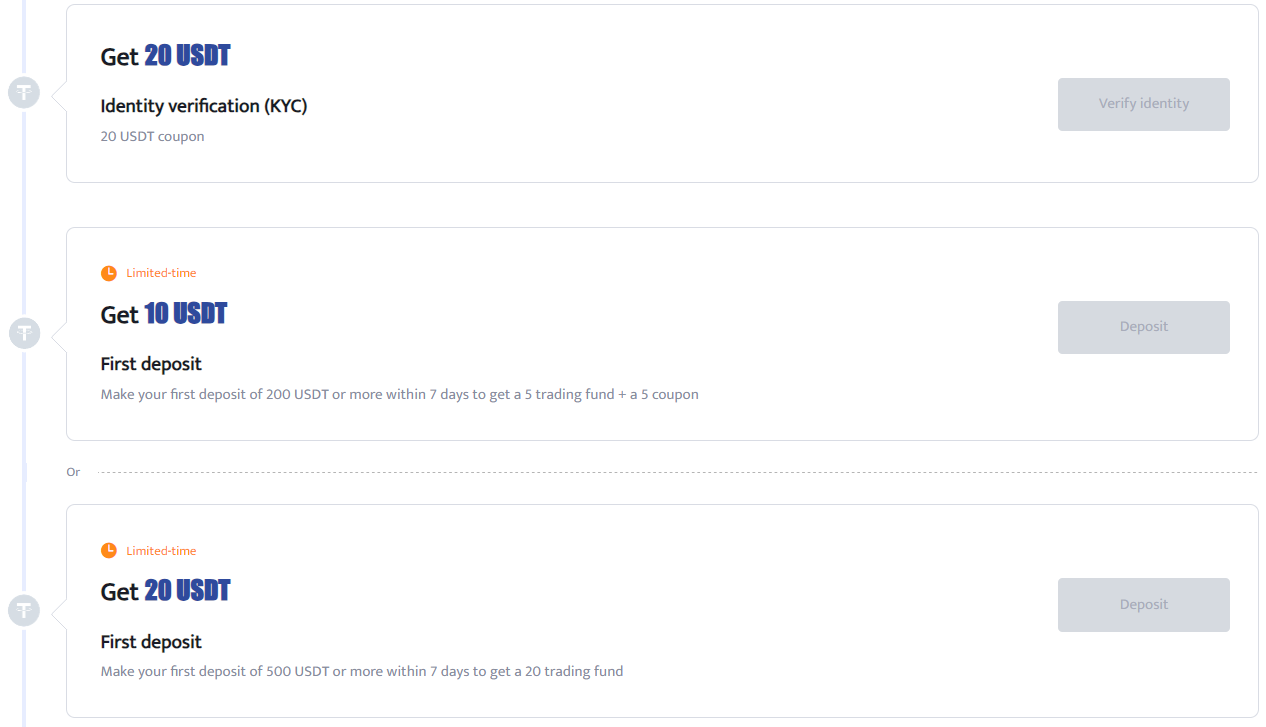

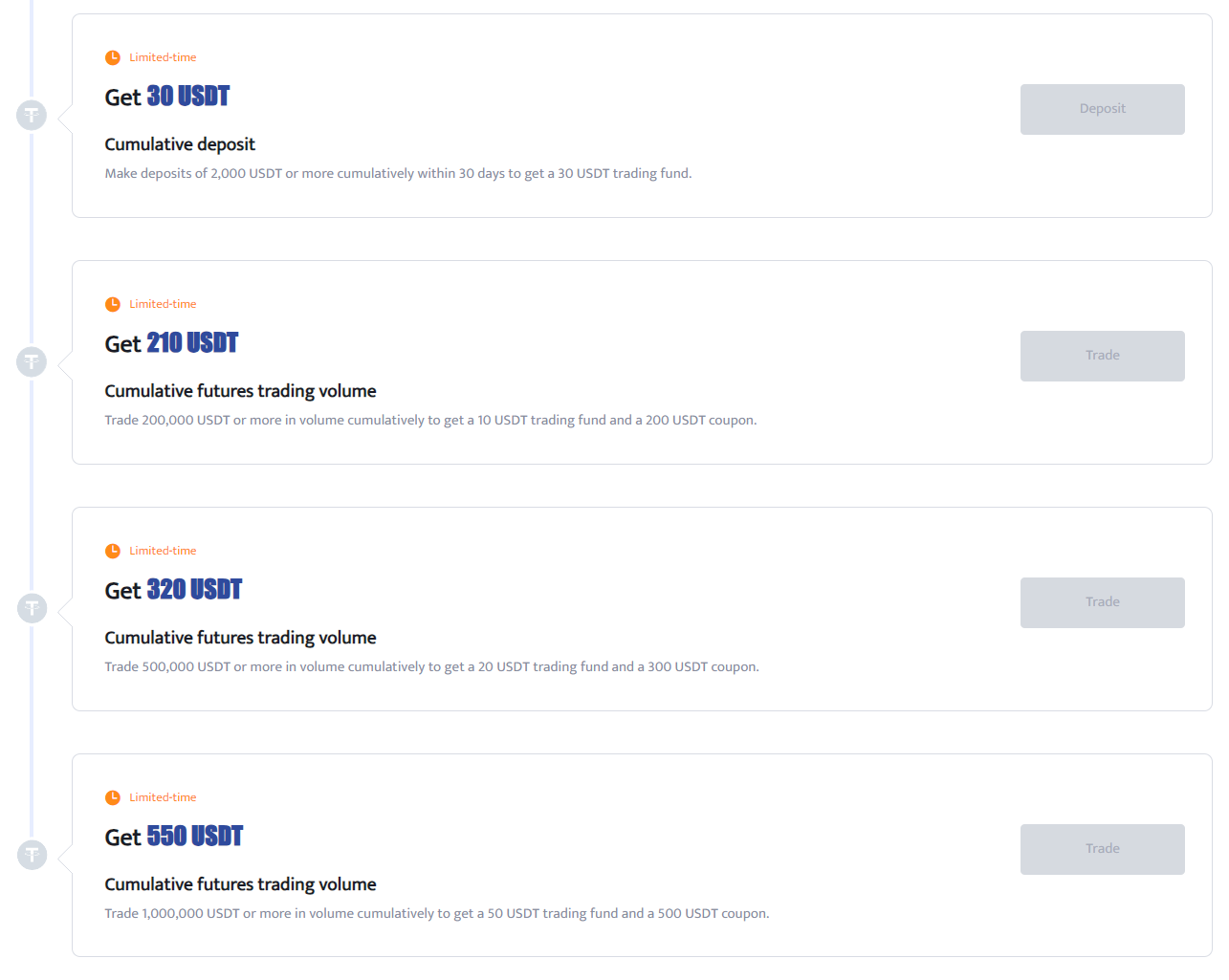

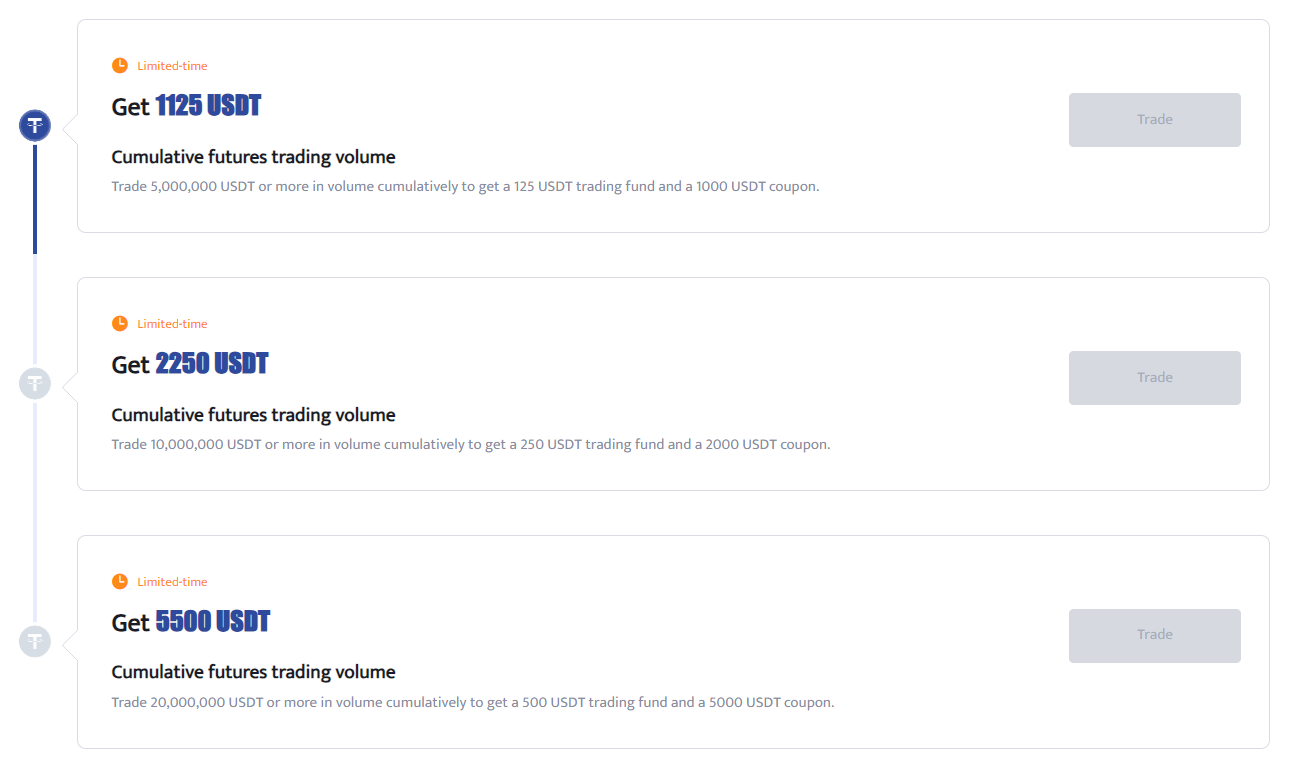

Trade on BTCC with 10 FREE USDT.

Sign up today to redeem your bonus.

Key Takeaways

- In the last year, the price of GOOG’s stock has increased by 49%.

- In 2023, Alphabet’s revenues climbed by over 9%, reaching $307.4 billion.

- CEO Sundar Pichai reiterates his dedication to artificial intelligence.

- The stock is rated as a “Moderate Buy” by Wall Street analysts.

- Under the Digital Markets Act, the European Commission has opened an investigation into Alphabet.

What is Alphabet?

Alphabet (Nasdaq: GOOG) is an American multinational technology conglomerate holding company that was created when Google was restructured in 2015. It is currently the parent company of Goggle and has a diverse revenue stream spread across search engines, social media, and cloud technologies.

Alphabet is one of the most valuable companies in the world. It is among the Big Five American information technology companies, alongside Apple, Microsoft, Amazon, and Meta (formerly Facebook). Alphabet is also recognized as the third-largest tech company in the world, by revenue.

Google started as a search engine, but Alphabet is currently a big tech company with a widely diversified interest. It offers products and services in computer hardware, internet, cloud computing, software, automation, artificial intelligence, robotics, biotechnology, autonomous cars, healthcare, corporate venture capital and more.

Google remains the most popular brand in Alphabet, but there are several other well-known brands of the holding company, including Google Fiber, DeepMind, Calico, CapitalG, GV, Intrinsic, Waymo, Verily, X Development, Wing, and Isomorphic Lab. The holding company was formed because the owners wanted to make Google’s business “cleaner and more accountable” while allowing other group companies to operate autonomously and efficiently in their respective industries/markets.

Google share price has shown a tremendous recovery in 2023. The price action follows a brutal sell-off in 2022 which took the price to as low as $83.

In its Q1 earnings report, the Google parent company reported a revenue of $69.79 billion. While the figure was more the Refinitive’s estimate of $68.95, the net profits of the company still decreased from $16.44 billion to $15.05 billion. Since the release of this earnings report, Google share price has been surging.

The second leg of AI hype is also one of the driving factors behind the increase in Alphabet stock price. However, the latest analysis shows that the bulls are finally losing momentum after a strong upward rally that took the price from its March lows of $89.42 to the recent highs of $127.

Alphabet (Google) StockFundamental Analysis

In the most recent Q1 2023 earnings report Google CEO Sundar Pichai said:

“We are pleased with our business performance in the first quarter, with Search performing well and momentum in Cloud. We introduced important product updates anchored in deep computer science and AI. Our North Star is providing the most helpful answers for our users, and we see huge opportunities ahead, continuing our long track record of innovation.”

The first quarter of the year was a relatively solid one for Alphabet, with its consolidated revenue coming in at $69.8bn, growing 3% year-over-year (YOY). However, earnings per share (EPS) was at $1.17 falling from $1.23 the previous year.

Costs and expenses also increased 3.4%, from $29.6bn in Q1 2022 to $30.6bn. This was likely to be expected, as in 2022 the company said it would take a charge of between $1.9bn and $2.3bn, mostly in the first quarter of 2023, related to the layoffs of 12,000 employees it announced in January. It also expected to incur costs of about $500 million related to reduced office space in Q1.

Meanwhile, on 21 April 2022, Alphabet announced that it would combine its DeepMind and Google Brain AI research units, ending a long-running internal rivalry between the London and Silicon Valley-based groups as it tries to make up lost ground in generative AI against Microsoft and OpenAI.

On 17 April, Alphabet lost about $55bn in market value after a report from The New York Times suggested that competition was heating up in the mobile search market.

Alphabet (Google) Stock Forecasts for 2024, 2025 & 2030

So should you purchase, hold, or sell Alphabet?

As of April 24, 2024, MarketBeat aggregated the 34 Wall Street analysts’ Alphabet share price projection, which rates the business as a “Moderate Buy.”

There are 28 buy recommendations in place, 1 “Strong Buy” recommendation, and 5 “Hold” recommendations for the stock.

Though views differ greatly, the general majority for Alphabet stock forecast 2025 is for the stock to increase by 0.28% to $158.71 during the upcoming year.

The most bullish experts predict that the stock price may drop as low as $130, but even they are cautious about it reaching $190.

The top ten analysts’ predictions for Alphabet stock are displayed in the following table.

| Date | Analyst Firm | Action | Rating Change | Price Target | Percentage Change |

| 4/22/2024 | KeyCorp | Boost Target | Overweight ➝ Overweight | $165.00 ➝ $175.00 | +13.57% |

| 4/19/2024 | Jefferies Financial Group | Boost Target | Buy ➝ Buy | $175.00 ➝ $180.00 | +15.38% |

| 4/17/2024 | Canaccord Genuity Group | Boost Target | Buy ➝ Buy | $180.00 ➝ $190.00 | +22.21% |

| 4/17/2024 | Truist Financial | Boost Target | Buy ➝ Buy | $158.00 ➝ $170.00 | +9.29% |

| 4/16/2024 | UBS Group | Boost Target | Neutral ➝ Neutral | $150.00 ➝ $166.00 | +7.19% |

| 4/10/2024 | Citigroup | Reiterated Rating | Buy ➝ Buy | $168.00 | +7.82% |

| 4/10/2024 | JMP Securities | Reiterated Rating | Market Outperform ➝ Market Outperform | $160.00 | +3.05% |

| 4/10/2024 | BMO Capital Markets | Reiterated Rating | Outperform ➝ Outperform | $178.00 ➝ $185.00 | +19.15% |

| 4/10/2024 | Wedbush | Reiterated Rating | Outperform ➝ Outperform | $175.00 | +11.75% |

Source: MarketBeat, as of April 24, 2024

Wallet Investor’s algorithmic forecasts indicate that the stock price may reach $159.19 in the upcoming year.

Although a 2030 prediction for Alphabet stock is too far off, the website projects a price of $177.76 for the stock through 2029.

Be aware that projections made by analysts and algorithms may turn out to be inaccurate.

Alphabet (Google) Stock Forecast 2025

The 45 analysts offering Google stock forecast 2025 have a median target of $330, with a high estimate of $360 and a low estimate of $290.

For 2025, Google stock is expected to build on the gain it has made over the year and become more valuable. This is the year we all expect that Google stock will hit the $300 mark.

Alphabet (Google) Stock Forecast 2030

For Alphabet Google stock forecast 2030, we will still reference the reliable data from experts.

According to analysts, Google stock price will be $900 by the end of the year 2030, with a max estimate of $950 and a low estimate of $830.

Should You Invest in Alphabet (Google) Stock?

Google has dominated the internet for several years. The foremost tech company had also diversified significantly to other profitable niches, even before the owners established Alphabet to serve as the holding company. It is now well-positioned to take advantage of recent tech trends and grow even bigger in the future.

It is also important to note that Google stock has been one of the most consistent gainers in the tech sector for years. The stock has grown from an IPO price of $85 to its recent price of more than $2500 per share (Before Split) in just 17 years and a few months. Looking at the price predictions sections above, you can see that industry experts expect the Alphabet (GOOG) stock to gain more in the future. Obviously, it is a good buy.

Are you planning to buy Google stock this year? You can go ahead as it appears like an all-round good investment.

Conclusion

In the coming months and years, how do you think the price of GOOGL stock will fluctuate?

Companies’ plans for digital advertising spending in the coming years will determine Alphabet’s future performance to a large extent.

The optimistic outlook holds that this number will keep going up as more and more people use the internet. Google, being a dominant player in the search engine industry, stands to gain from this.

But this income stream is crucial to the company’s survival, so if this section lets the company down, the stock price will take a beating.

It should be mentioned that Alphabet has never announced or distributed a dividend. It has declared that “the primary use of capital continues to be to invest for the long term growth of the business.”

FAQs

Are Alphabet and Google the same company?

Alphabet is the holding company for Google and other brands that were formerly under it before it was restructured in 2015. Though the two names are often used interchangeably, Alphabet is the major international multinational that controls Google and several old and new subsidiaries. The Google (GOOG or GOOGL) stock, however, is the same thing as the Alphabet (GOOG) stock.

Is Google stock a profitable investment?

Google stock has been a very good investment. Google was a highly profitable company before restructuring to make Alphabet the holding company. As a group, Alphabet is generally profitable. The stock has also been gaining value consistently, making it a very attractive investment option. Overall, it is a profitable investment.

Will Google stock price reach $1000?

From all indications, the Google stock can reach $1000 in the future. Based on the data we have at hand, it will take a long time for this to happen, but it is almost inevitable. We don’t expect Google stock to hit $1000 before 2030, but it will certainly get to that range maybe within the next ten years.

Is Google stock a good investment?

If we are to rely on how well it has performed in the past and how well it has been projected to perform in the future, Google stock is a good investment for the future. Again, considering what Google and other brands owned and controlled by Alphabet has achieved, there is no reason to doubt the future of Alphabet (GOOG) stock. It is an excellent investment that can get even better in the future.

Where to buy Google shares?

BTCC is one of the best platforms as it witnesses a large trading volume of GOOGL. The exchange is highly recommended due to its favourable attributes such as extremely low fees, user-friendly interface, excellent customer support, and robust security measures with no reported hacks or security breaches to date.

Furthermore, BTCC is a one-stop trading platform, allowing users to trade cryptocurrencies, stocks and commodities futures with USDT.

Buying GOOGL stocks on BTCC is simple. Check here to create an account on BTCC and choose to purchase GOOGL with USDT and a leverage up to 50x.

How to Trade Crypto Futures on BTCC?

Now you can trade BTC on BTCC. BTCC supports a diverse selection of cryptocurrencies for trading. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. BTCC also offers products such as crypto, gold, and tokenized stocks to help investors rationally allocate their assets.

1. Register an Account

Join BTCC now and get up to 10,055 USDT when you deposit and trade. Click the button below to sign up now.

2. Deposit Funds

Once your account is set up, you’ll need to deposit funds into your BTCC account. BTCC may offer various deposit methods such as bank transfers, cryptocurrency deposits, or other payment options. Choose the method that works best for you and follow the instructions provided to deposit funds into your account. BTCC mainly offers USDT margin and future trading. Therefore, you need to buy USDT before trading.

3.How to Trade BTC?

Here are the steps to trade BTC on BTCC

1) First, tap “Futures” on the website homepage

2) Select a product you would like to trade from the list here. BTCC currently offers daily and perpetual futures

3) Check time to settlement. The settlement time of these futures type is different, you can check the time for settlement for each product here.

4) After choosing product, you can decide whther you would like to buy or sell it. You only need to own USDT to trade USDT-margined futures. That is to say you can sell BTCUSDT futures without owing any BTC Coin.

5) Then select your order type, and choose your leverage.

If you choose Limit or SL/TP order, you will need to enter your order price here.

Enter the quantity or choose the percentage under the quantity field.

You can also set up stop loss or take profit targets to limit losses or maximise earnings.

6)After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

BTCC FAQs

1.Can U.S. traders use the BTCC exchange?

Of course, BTCC accepts US traders on its platform. They can sell, purchase, or trade bitcoins in the excess marketplace using the BTCC exchange. And, of course, any USD deposits must be KYC-verified first.

2.What can you trade on the BTCC?

BTCC allows users to trade over 300 crypto futures, including USDT-margined and coin-margined options. Traders can use up to 225x leverage to enhance their trades. Furthermore, the site provides handy choices for both cryptocurrency and fiat deposits.

3.Is BTCC the ideal exchange for you?

If Bitcoin trading is your top priority, BTCC is definitely the finest exchange for you. This company has been focused on Bitcoin since 2011 and provides a user-friendly platform for all types of traders, both experienced and new.

4.Is the BTCC Exchange trustworthy?

BTCC has a 13-year track record of secure operations, with zero security problems. Along with this, it has adopted current security measures, making it a safer and more trustworthy environment than its contemporaries.

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?