Bullish Stock Price Prediction & Forecast 2025 To 2030: Is BLSH Stock A Buy Now?

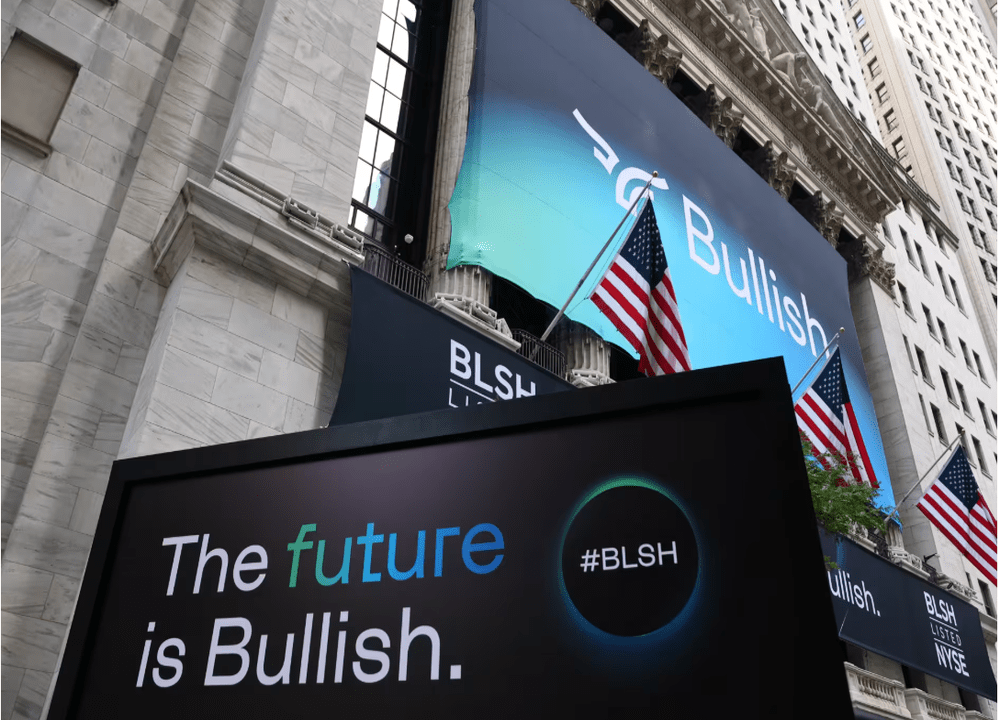

Crypto firm Bullish is drawing great attention as it has filed for an initial public offering (IPO) on the New York Stock Exchange under the ticker symbol BLSH, targeting a valuation of between $3.8 billion and $4.2 billion. Bullish made its debut and started trading on Aug. 13 with a IPO price of $37 per share, surpassing the anticipated range of $32–$33.

Notably, Bullish stock opened for trade at $90 near 1:00 p.m. ET on 13, August, and the stock traded hands as high as $118 per share shortly after, a more than 215% gain. As speculation around the investment potential of Bullish continues to grow, both traders and long-term investors are asking: What will Bullish stock be worth? Is Bullish stock a good investment in 2025?

This article provides in-depth analysis of Bullish company, including its IPO journey, BLSH stock price prediction for 2025 to 2030, future outlook and key valuation metrics to help investors decide whether this high-growth tech stock is right for your portfolio.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

Table of Contents

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What is Bullish: A Quick Overview

Launched in 2021, Bullish is a crypto exchange platform associated with Peter Thiel. It provides trading infrastructure and digital asset news services to institutional traders globally. Positioning itself as a regulated, compliance-first alternative for institutions, the platform offers spot, margin, and derivatives trading.

Bullish has also become a major player in the perpetual futures industry, handling $111 billion. Bullish is seeking to enter the growing options market, where companies like Binance and Deribit dominate.

Bullish owns CoinDesk, a company that expands beyond one of the crypto industry’s largest website. CoinDesk runs Consensus, one of the biggest events in the crypto industry, and operates an index business with over $41 billion in assets under management.

Bullish is also a big holder of Bitcoin in its balance sheet. It ended the quarter with over 24,000 coins, meaning that it will become the fifth biggest publicly-traded holder after Strategy, MARA, XXI, and BSTC.

Bullish’s business is growing, with its trading volumes doubled in 2023, with a further increase of 78% reported in the first quarter of 2025 compared to the same period the previous year. Additionally, Bullish forecasts a net income increase of approximately $225 million for the quarter ending 30 June 2025, largely due to favorable digital asset valuations rather than operating income.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Bullish IPO: A Full Review of Its IPO Journey

Bullish officially submitted its IPO registration (Form F-1) to the U.S. Securities and Exchange Commission (SEC) on August 4, 2025, with plans to offer 20.3 million shares priced between $28 and $31 per share, aiming to raise up to $629 million in proceeds. The IPO is planed to happen on August 13, 2025, with trading expected under the ticker symbol “BLSH” on the New York Stock Exchange. The lead underwriters for this offering include J.P. Morgan, Jefferies, and Citigroup.

At the upper end of the proposed range, Bullish would be valued at approximately $4.2 billion based on the number of outstanding shares detailed in an amended F-1 document filed with the SEC. The IPO also includes an option for underwriters to purchase an additional 3.045 million shares, which could further enhance total proceeds from the offering. According to the filing, funds managed by BlackRock and ARK Investment Management have expressed interest in acquiring up to $200 million worth of stock at the offering price.

Bullish’s listing follows a broader trend of digital asset firms entering public markets, a development that has gained momentum under the Trump administration. In recent months, firms like stablecoin issuer Circle and trading platform eToro have gone public, while others, including BitGo and Grayscale, have filed to follow suit. Major exchanges Kraken and OKX are reportedly considering similar moves.

Bullish made its debut on 13 August, starting trading at an IPO price of $37 per share — surpassing the anticipated range of $32–$33. The company’s debut rode the outsized success of recent go-publics like Figma (FIG) and Circle (CRCL) and served as the latest sign that the IPO window remains wide open after a few challenging years for investors. The stock opened at $90, reached a high of $118 and closed at $68 — an increase of 85% from the offering price. This surge reflects optimism in the market towards crypto-related equities, as well as highlighting growing institutional interest in digital asset platforms.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

What’s the Significance of Bullish IPO?

Bullish plans to use the IPO proceeds to expand its product offerings — including the introduction of options trading — and strengthen its global footprint. The company also intends to increase its influence in the crypto media sector by building on its ownership of CoinDesk to enhance its information services.

The move towards public listings is expected to accelerate the adoption of digital assets by institutional investors by providing regulated and transparent platforms. Bullish’s compliance-driven model is designed to meet the stringent requirements of institutional investors while fostering trust with regulators. This approach could set a precedent for other crypto firms seeking to access public capital and establish long-term credibility in this ever-evolving market.

With its strong institutional alignment, substantial trade volume and media ownership, the firm’s business model may attract long-term investors seeking broad crypto exposure via regulated equities rather than spot tokens. Investors and market participants are expected to watch Bullish closely as it enters the next phase of its growth strategy.

Furthermore, Bullish’s IPO is a significant milestone not only for the company, but also for the maturing crypto industry. Following Circle’s blockbuster debut in June 2025, Bullish represents one of the most prominent crypto IPOs in years. A successful listing could signal a renewed appetite among investors for digital asset firms in public markets, paving the way for other major exchanges, such as Kraken or Gemini, to follow suit. As more exchanges enter the public market, the sector moves closer to mainstream acceptance, supported by improved regulatory clarity and institutional demand.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Bullish Stock Price Prediction 2025 to 2030

Given the historical tendency for IPOs to be underpriced to stimulate demand, Bullish could generate an IPO “pop” on its first trading day—assuming investor enthusiasm mirrors past crypto listings like Circle, which surged 400% post-IPO.

The Bullish IPO is coming at a time when there is strong appetite for listings in the United States. Institutional interest from major asset managers such as BlackRock and ARK, who have shown non‑binding interest in buying up to $200 million in shares, suggests robust demand and confidence in Bullish’s growth potential.

Moreover, with regulatory clarity improving—such as the passage of the GENIUS Act, which provides frameworks for stablecoins—Bullish stands to benefit from enhanced market legitimacy and institutional adoption.

With its IPO oversubscribed, it is likely that the price of Bullish stock will rise as investors rush to buy. Demand will also be supported by broader strength in the crypto market, with Bitcoin near its all-time high and Ethereum approaching resistance at $4,500.

Given above factors, we made a price prediction for Bullish stock in the chart below:

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2025 | $30 | $55 | $80 |

| 2026 | $40 | $70 | $100 |

| 2030 | $60 | $90 | $120 |

Note: These forecasts are speculative and based on current market assumptions. Real outcomes may vary depending on macroeconomic trends, regulatory developments, and Bullish’s performance in the competitive crypto infrastructure space.

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Bullish Stock Future Outlook

Bullish has experienced significant revenue growth over the past three years. While the company reported digital asset sales of $72.9 million in 2022, this figure had grown to $250.2 million by 2024. In the first three months of 2025, Bullish’s digital asset sales totalled $80.2 million, compared to $80.4 million in the same period last year.

The market in which Bullish operates is quite promising. A report released in 2025 by Spherical Insights estimated the value of the global digital asset trading platform market at around $2.5 billion in 2023. The same report expects this figure to reach close to $11 billion by 2033, representing a compound annual growth rate of around 16%. This would represent a compound annual growth rate of around 16%, underlining the industry’s strong growth potential.

In such an environment, Bullish has certain advantages. It offers a comprehensive suite of trading and market intelligence services, and its management team boasts significant industry experience. Its expansion plans centre on obtaining further regulatory approvals to enter new regions, developing additional products, evaluating buyout opportunities and strengthening the links between its trading, data and media operations.

However, competition is fierce. Major exchanges such as Coinbase (COIN) and Robinhood (HOOD) continue to dominate the market. Additionally, Bullish’s status as a foreign private issuer permits a lower level of financial disclosure than would be required for a domestic listing. Furthermore, the company’s substantial holdings of digital assets can make its earnings vulnerable to fluctuations in asset valuations, which could introduce volatility to results and raise transparency concerns.

Should You Buy Bullish Stock After IPO?

As for whether Bullish stock is a good investment, it is important to consider the benefits and risks for investing in Bullish:

| Benefits to Consider | Risks to Weigh |

|---|---|

| Institutional-grade platform with strong backing and high-volume trading performance. | Reported a $349 million loss in Q1 2025 due to crypto market volatility and asset valuation adjustments. |

| Ownership of CoinDesk provides operational synergy, boosting brand visibility and access to proprietary market data. | Market enthusiasm could drive short-term overvaluation; studies show IPOs with high pre-launch hype often underperform in the long term. |

| Strategic use of IPO proceeds converted into USD stablecoins, strengthening liquidity and reducing exposure to crypto price swings. | Long-term performance may face pressure if the platform cannot sustain user growth and institutional demand amid broader market fluctuations. |

[TRADE_PLUGIN]BTCUSDT,ETHUSDT[/TRADE_PLUGIN]

Conclusion

Bullish’s IPO is a landmark event in crypto finance, offering both excitement and caution. Strong institutional support, a renewed regulatory environment, and proven trading performance all enhance its appeal. However, as public equity markets increasingly become a vehicle for crypto-sector fundraising, companies like Bullish that offer exposure to the emerging industry’s plumbing are under pressure to differentiate themselves.

Short-term gains may result from underpricing and hype, but long-term returns will depend on Bullish’s ability to scale operations, achieve profitability, and maintain regulatory compliance. For investors with a strategic outlook, Bullish stock could offer compelling entry into the regulated crypto ecosystem—provided they diligently evaluate fundamentals, market risks, and broader sector dynamics.

\Unlock Up To 10,055 USDT In Welcome Rewards!/

About BTCC

Holding regulatory licenses in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to trade cryptos in the world. The reasons why we introduce BTCC for you summarize as below:

- Industry-leading security

- High Liquidity & Volume

- Extremely low fees

- High and rich bonus

- Excellent customer service

\Unlock Up To 10,055 USDT In Welcome Rewards!/

BTCC Guide:

Understanding KYC In Crypto: How To Complete KYC On BTCC

A Beginner’s Guide: What Is Copy Trading & How To Start Copy Trading On BTCC

How to Use BTCC Demo Trading: A Step-By-Step Guide For Beginners In 2025

Investing Guide:

NVIDIA (NVDA) Stock Price Prediction & Forecast 2025-2030: Is NVDA Stock A Buy Now?

Hut 8 Stock Price Forecast & Prediction 2025: Is Hut 8 Stock a Buy Now?

Circle (CRCL) Stock Price Forecast & Prediction: Is Circle Stock A Buy Now?

Vanguard S&P 500 ETF (VOO) Stock Price Forecast & Prediction: Is VOO Stock a Buy Now?

What Is Tapzi (TAPZI) Crypto: A Comprehensive Review & Analysis

Polyhedra Network (ZKJ) Price Prediction 2025 To 2030: Can ZKJ Hit $5?

What Is Ibiza Final Boss ($BOSS) Crypto: Next 100X Meme Coin On Solana?

401(k) Crypto Trump: Everything You Need To Know About It

Mamo (MAMO) Price Prediction 2025 To 2030: Can MAMO Hit $1?

INFINIT (IN) Token Launches on Binance Alpha With Airdrop: Everything You Need To Know About It

Trusta.AI (TA) Price Prediction: How High Can Trusta.AI Go Post Binance Listing?

Flare ($FLR) Price Prediction 2025, 2026 And 2030: Can FLR Hit $1?

World Liberty Financial (WLFI) Price Prediction: Can WLFI Hit $1?

Vision (VSN) Price Prediction: Can VSN Hit $1?

FUNToken (FUN) Price Prediction: Can FUNToken Hit $0.1?

MemeCore (M) Price Prediction: Can $M Hit $1?

Bitcoin Hyper (HYPER) Meme Coin Review & Analysis: Next 100x Token?

TOKEN6900 ($T6900) Review & Analysis: Next 100x Meme Coin To Explode?

Martini Market ($MRT) Review & Analysis: Next 100x Token To Explode?

Angry Pepe Fork ($APORK) Meme Coin Review & Analysis: Next 100x Gem?

Best Free Bitcoin Accelerators 2025

Best Crypto & Bitcoin Casinos Australia 2025

Top Crypto & Bitcoin Casinos Canada 2025

Midnight Airdrop Guide: How To Claim NIGHT Tokens?

Linea Airdrop Guide: How To Claim LINEA Tokens?

Eclipse Airdrop Now Live: How to Claim ES Tokens?

UPTOP Goes Live on Binance Alpha: Everything You Need to Know About This Crypto and Its Airdrop

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

Yala (YALA) Debuts On Binance Alpha: Everything You Need To Know About This Crypto And Its Airdrop

Crypto Basics Guide:

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is Atrium Crypto: A Comprehensive Review & Analysis

What Is Redakciya.info Crypto: Is It Legit Or A Scam?

What Is Swapfone: Everything You Need To Know About This US-Based Crypto Exchange

Eli Regalado Crypto: Who Is He & Why Is He Involved In The Crypto Scam?

FaZe Banks Crypto: Who Is He & Why Is He Involved In The Crypto Scadal?

How to Sell Pi Coin in Canada: A Complete Guide for 2025

How To Use Pi Network’s Mainnet In Canada: An Ultimate Guide In 2025

Pi Network (PI) Price Prediction: Will Pi Coin Reach $10 Amid Binance Listing Rumors?

What is Etherions.com Tech: Something You Need To Know About It

What Is Facto Crypto FintechAsianet: Everything You Need to Know About It

What Is BlackRock: Everything You Need to Know About the World’s Largest Asset Manager

Best Sign-Up Bonus Instant Withdraw No Deposit Crypto Apps 2025

How To Withdraw Money From Binance In Canada: A Useful Guide For 2025

What Is SUV Bitcoin Miner APK: Everything You Need To Know About It

Coinbase vs. CoinSpot: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

eToro vs. CoinJar: Which Is A Better Crypto Trading Platform For Australian Traders In 2025

Coinspot vs. Swyftx: Which Is A Better Crypto Trading Platform For Australian Traders In 2025?

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]