XRP ETF Review & Analysis: Top Analyst Says Spot XRP ETF To Be Approved In 2025

Since the approval of BTC ETF and ETH ETF in 2024, more and more crypto analysts are wondering which cryptocurrency would be the next. According to leading ETF analysts Nate Geraci, a spot-based XRP ETF will end up being approved this year.

There is no denying that XRP ETF approval would exert huge and profound influence on XRP price and the whole crypto market. Then, what is a XRP ETF? Next, let’s dive in this financial product, analyzing whether it is a good investment amid the current bull run cycle.

BTCC, one of the longest-running crypto exchanges in the world, supports trading for 300+ cryptocurrencies with leverage ranging from 1Χ to 500Χ. If you want to start trading cryptocurrencies, you can start by signing up for BTCC.

\Trade On BTCC With 10 FREE USDT!/

Table of Contents

Latest News & Updates on XRP ETF

What are the Significance of Spot XRP ETF Launch?

What is the Influence of Spot XRP ETF Approval on XRP Price?

What is the Influence of Spot XRP ETF Approval on the Broader Market?

Where & How To Buy Ripple (XRP)?

\Trade On BTCC With 10 FREE USDT!/

Latest News & Updates on XRP ETF

The securities regulator has already approved spot Bitcoin and spot Ether ETFs, setting the stage for broader cryptocurrency investment products. The recent departure of former SEC Chair Gary Gensler has further shifted the agency’s approach, with his successor adopting a more crypto-friendly stance.

Under the new leadership, the SEC has paused or dropped several lawsuits against crypto firms, fueling speculation that Ripple’s ongoing legal battle could soon be dismissed as well. This shift in regulatory climate has sparked optimism that the approval process for an XRP ETF could be smoother than previous crypto ETF applications.

Following the SEC’s acknowledgment of the XRP ETF on Friday, February 14, 2025, significant progress was made in the US XRP-spot ETF movement. The SEC officially began reviewing another XRP-spot ETF after approving the 19b-4 application from 21Shares.

The Federal Register published Grayscale’s XRP ETF proposal on February 20, 2025, marking the official start of the SEC’s review process. This, along with the SEC’s acceptance of Grayscale’s application, suggests a potential shift in regulatory attitudes toward XRP, generating optimism in the market and fueling bullish XRP price predictions.

The SEC follows a structured timeline when reviewing ETF proposals under the 19b-4 process. Initially, the agency has 45 days from publication to make a decision or request an extension. If extended, the SEC can push the deadline to 90 days. Further extensions, with additional review periods of 45 and 60 days, could stretch the timeline until October 18, 2025.

With the publication in the Federal Register, the SEC will now open a public comment period before making a final decision on the Grayscale XRP ETF. If approved, the ETF would enable investors to trade XRP ETF shares on a regulated exchange, potentially increasing liquidity and accessibility for XRP. The crypto community is closely monitoring the SEC’s ruling, as it could have broader implications for the future of cryptocurrency ETFs and digital asset adoption.

XRP USDT-margined perpetual futures contract with a leverage of up to 500x is available on BTCC. If you are interested, click the button below to buy XRP ⇓

[TRADE_PLUGIN]XRPUSDT,XRPUSDT[/TRADE_PLUGIN]

\Trade On BTCC With 10 FREE USDT!/

What is a XRP ETF?

An XRP ETF is a financial product designed to track the price of XRP, the digital asset native to the XRP Ledger. This investment vehicle enables traders to gain exposure to XRP’s price movements without the need to directly purchase, store, or manage the cryptocurrency itself.

XRP ETFs operate within the regulatory framework of traditional financial markets, providing investors with a regulated and secure channel to engage in cryptocurrency investments. This regulatory oversight enhances investor confidence and ensures compliance with established financial standards.

XRP ETFs offer many benefits, like accessibility, regulatory oversight, ease of trading, and the ability to diversify investment portfolios. Trading on major stock exchanges, XRP ETFs provide liquidity and simplicity for investors who may be new to cryptocurrency markets.

\Trade On BTCC With 10 FREE USDT!/

What are the Significance of Spot XRP ETF Launch?

Just like spot Bitcoin ETFs and Ethereum ETFs, XRP ETF approval will provide many revolutionary benefits.

- Access to XRP: for those traders who are unwilling to trade volatile cryptocurrencies through crypto exchange, they can now get exposure to XRP through their existing brokerage accounts. With existing brokerage account, investors are capable of buying and selling them like stocks without the need for cryptocurrency wallets or complicated exchange tracking.

- Increased Legitimacy: under the current regulatory framework, whether it is legit to trading cryptocurrency vary from country to country. While having an XRP ETF listed only on major exchanges will give the cryptocurrency industry as a whole more legitimacy and recognition while bridging the divide between traditional finance and the rapidly expanding realm of digital assets.

- Reduced security risks: by avoiding the need for individual cryptocurrency wallets, investors reduce exposure to hacking attacks and security issues related to digital assets. Additionally, ETFs are governed by regulations, which provide a degree of security and transparency not necessarily found in the Bitcoin market.

- Increased Liquidity: if more institutional and general investors engage in XRP trading through ETFs, XRP’s liquidity can increase significantly. Everyone will benefit from smoother, less volatile trading as a result, including large funds and small traders.

[TRADE_PLUGIN]XRPUSDT,XRPUSDT[/TRADE_PLUGIN]

What is the Influence of Spot XRP ETF Approval on XRP Price?

The approval of the spot XRP ETF is expected to have a positive impact on XRP prices. This is because XRP ETF will create a simpler mechanism for investors to gain exposure to XRP. We could see new investors opening XRP positions through the spot XRP ETF.

What’s more, industry experts maintain a positive outlook on Ripple’s future, with Monica Long highlighting that the approval of an XRP ETF could open doors for both institutional and retail investors. The momentum gained from the successful launch of Bitcoin and Ethereum ETFs could potentially expedite the regulatory process for XRP.

As of writing the article, XRP is traded at $ 3.1634, boasting a market cap of $ 187.4B, and witnessing a hefty 24-hour trading volume of $ 7.1B. XRP saw a 24-hour price change of 0.88%, with minor fluctuations of -0.47% in the past hour.

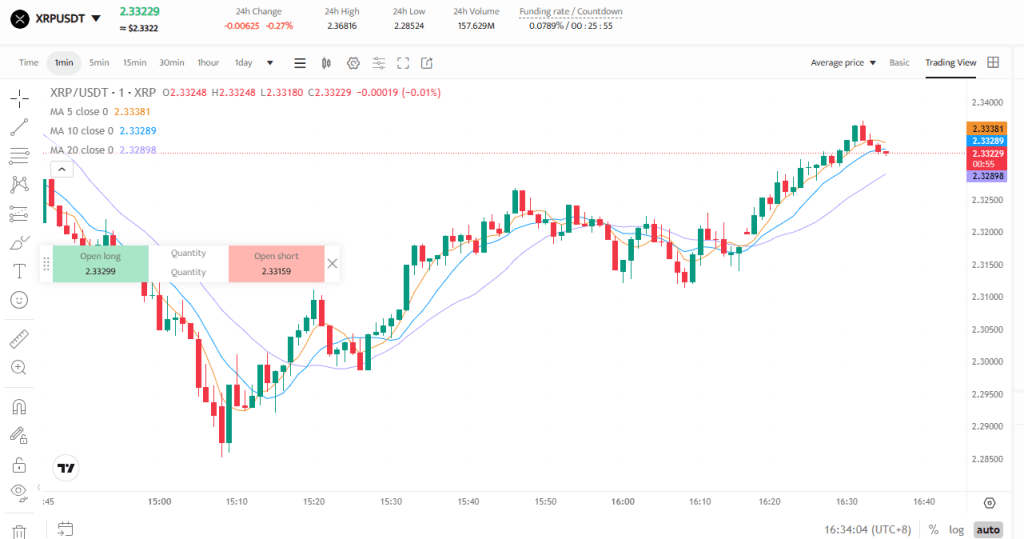

The following sets forth the XRP to USD Price Chart

XRP USDT-margined perpetual futures contract with a leverage of up to 500x is available on BTCC. If you are interested, click the button below to buy XRP ⇓

[TRADE_PLUGIN]XRPUSDT,XRPUSDT[/TRADE_PLUGIN]

\Trade On BTCC With 10 FREE USDT!/

What is the Influence of Spot XRP ETF Approval on the Broader Market?

This approval for XRP ETF undoubtedly represents a big victory for the crypto industry, which has been hoping for the approval of spot XRP ETFs since similar products for Bitcoin and Ethereum were approved in 2024. What is the impact on the market after XRP ETF getting approval. Let’s discuss them in detail.

As regulatory frameworks surrounding cryptocurrency continue to evolve, investor sentiment towards digital assets is undergoing a notable shift. The introduction of an XRP ETF may not only enhance liquidity but also solidify XRP’s status as a legitimate investment asset. Furthermore, with an increasing number of prominent financial institutions expressing interest in cryptocurrency ETFs, the market appears to be moving toward broader acceptance. Analysts suggest that the launch of an XRP ETF could significantly influence overall market dynamics by attracting a new demographic of investors eager to engage with regulated products.

The performance of Bitcoin and Ethereum ETFs has established a strong benchmark for the potential entry of XRP into this space. For context, the launch of Bitcoin ETFs sparked considerable investor interest, resulting in substantial inflows that further reinforced Bitcoin’s position within the market. This serves as a crucial lesson for XRP; market observers anticipate that a similar trend could emerge should an ETF receive approval. Additionally, notable firms such as Bitwise and WisdomTree are already preparing to introduce their own XRP ETFs, indicating a robust competitive landscape ready to capitalize on this forthcoming opportunity.

The anticipated approval of a spot-based XRP ETF could potentially transform the cryptocurrency landscape, attracting significant inflows that rival those seen with Bitcoin and Ethereum. Research from JPMorgan suggests that such an ETF could generate between $3 billion and $8 billion in investments based on current trends observed in Bitcoin ETFs, which account for approximately 8% of its total market capitalization valued at $1.81 trillion. In contrast, Ethereum ETFs only capture around 3%, highlighting a larger untapped market potential for XRP.

\Trade On BTCC With 10 FREE USDT!/

Where & How To Buy Ripple (XRP)?

XRP USDT-margined perpetual futures contract with a leverage of up to 500x is available on BTCC. If you are a newcomer, please follow the below step-by-step guidance to place your Ripple (XRP) order.

Step 1: Create a BTCC account

Step 2: Complete BTCC’s identity verification

Step 3: Fund your BTCC account

On the BTCC official homepage, choose “Deposite”, and then fund your account with your preferred method

Step 3: Place your Ripple (XRP) order on BTCC

Go back to the BTCC official homepage, choose “Futures” -“USDT-M Perpetual Futures Contract”, and find XRP/USDT trading pair.

You can also directly click the button below to enter the XRP order page.

[TRADE_PLUGIN]XRPUSDT,XRPUSDT[/TRADE_PLUGIN]

Step Four: choose the contract trading order type. Futures contract orders on BTCC platform include market orders, limit orders and SL/TP orders.

- Market Order: users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit orders are a type of order to buy or sell futures at a price more favourable than the market price. When you buy at a price lower than the market price or sell at a price higher than the market price, the order will be in the form of a limit order.

- SL/TP Order: SL/TP orders are a type of order to buy or sell futures at a price less favourable than the market price. When you buy at a price higher than the market price or sell at a price lower than the market price, the order will be in the form of a SL/TP order.

Step Five: adjust the leverage multiple.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

Step Six: choose the lot size and set the SL/TP price .

Step Seven: after setting the basic data information, users can choose to buy (open long) or sell (open short) after entering their ideal price. Traders should remind that the price cannot be higher or lower than the highest buying price or lowest selling price of the platform.

Step Eight: click the buy or sell button, and XRP futures contract order is completed.

\Trade On BTCC With 10 FREE USDT!/

Abou BTCC

If you want to trade XRP crypto, we advise you to start with BTCC, one of the longest-serving exchanges in the world. Fully licensed and regulated in the U.S., Canada, and Europe, BTCC is a well-known cryptocurrency exchange, boasting an impeccable security track record since its establishment in 2011, with zero reported hacks or breaches. BTCC platform provides a diverse range of trading features, including demo trading, crypto copy trading, spot trading, as well as crypto futures trading with a leverage of up to 500x. If you want to engage in cryptocurrency trading, you can start by signing up for BTCC.

BTCC is among the best and safest platforms to buy XRP crypto. The reasons why we introduce BTCC for you set forth as below:

Industry-leading security

BTCC attaches great importance on security. Since founded in 2011, BTCC has never been hacked or been a victim of any other kind of successful malicious attack, which fully illustrates its security capabilities. Through measures like segregation of assets, 1:1 storage of users’ assets, money laundering prevention and identity authentication and no collateralising tokens for loans, BTCC enjoys good reputation in asset security.

High Liquidity & Volume

BTCC is ranked top 10 by trading volume on both CoinMarketCap and CoinGecko, the world’s two largest crypto information platforms. BTCC prides itself on providing crypto futures trading services to users worldwide with market-leading liquidity, offering perpetual futures on over 300 cryptocurrencies, including BTC, ETH, DOGE, LTC, SOL, XRP, SHIB, etc.

Extremely low fees

Charging high fees means less return for investors. Compared with other major exchanges, BTCC only charges 0.06% for both takers and makers, which are far below the industry average. According to the largest and most recent empirical study on crypto exchange trading fees, the average spot trading taker fee is 0.2294% and the maker fee is 0.1854%.

High and rich bonus

BTCC holds all kinds of campaigns where investors can participate to win exciting bonus. For example, new users can get rewards up to 10,055 USDT coupon through completing relevant missions, like registration, identity verification, first deposits, cumulative futures trading volume, etc. Besides, becoming VIP also can enjoy rewards like VIP-exclusive perks, including discounts on trading fees, access to exclusive campaigns, BTCC merch, priority customer support, fast withdrawal, and many more.

Excellent customer service

BTCC also gains great reputation in terms of customer support. If you are confused or have problem in the process of trading currencies, you can obtain customer support via email and live chat, BTCC offers 24/7 online customer service for you.

\Trade On BTCC With 10 FREE USDT!/

Recommended for you:

Bybit Hack: Everything You Need To Know About It

How to Sell Pi Coin in Canada: A Complete Guide for 2025

Pi’s Open Mainnet Goes Live On February 20: Everything You Need To Know About It

How To Buy Pi Network (PI): A Comprehensive Guide In 2025

Pi Network Mainnet Launch Now Goes Live: Pi Network Price Prediction Post Mainnet Launch

Pi Network (PI) Price Prediction: Will Pi Coin Reach $500 After Major Exchange Listings?

How to Buy Ripple (XRP) In Canada: A Complete Guide For Beginners

A Beginner’s Guide: How To Buy Meme Coins In Canada In 2025

A Beginner’s Guide: How to Trading Crypto in Canada in 2025

Buy Bitcoin Canada: A Complete 2025 Guide

How to Buy Binance Coin (BNB) In Canada: A Comprehensive Guidance For Beginners

How to Buy Shiba Inu (SHIB) in Canada

Trump Wins 2024 Presidential Election, Boosting Bullish Sentiment Within Crypto Community

Best Crypto Trading Bots in Canada for January 2025

BTCC vs. Bybit vs. eToro:which is the best choice for you?

Compare BTCC vs. Binance: Which is a Better Choice for Canadian Traders in 2025?

BTCC vs. NDAX: which is a better choice for crypto trading in Canada?

How to Choose Best Crypo Exchanges in Canada